When running a business, there are always many plates to spin. With how busy a day can be, analytics might just be the last thing on your mind. But we know how important analytics can be. You may be familiar with some of the digital marketing metrics like Click-Through Rate (CTR), Cost Per Click (CPC), and Conversion Rate (CVR). There are two more important metrics you need to know – Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV).

Having a good knowledge of Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV) is essential if you want to be successful in your online marketing. Furthermore, it helps you better evaluate if your paid search campaign is profitable and how to optimize it. In this post, I will explain what these metrics mean, how they differ from each other, and how they are related.

First and foremost, it is crucial for you to understand that all of these metrics are directly related to your digital marketing strategy. They help you understand the performance of advertising from a business level.

What Exactly Is Customer Acquisition Cost or CAC?

In a nutshell, CAC is the total amount that you as a company are spending to convert a potential customer to become your actual customer. The concept is similar to that of cost per action or CPA. While there are some similarities, there are also some differences.

The easiest way to differentiate these two metrics is by recognizing that, CPA is more of a campaign level metric. Whereas CAC is a lot more overarching as it is a business-level metric.

It is true that CAC comprises the cost of obtaining business using various offline and online marketing efforts. Things such as billboards, Google Ads, media placement, Linkedin and Facebook ads and so forth.

Here’s How You Calculate CAC:

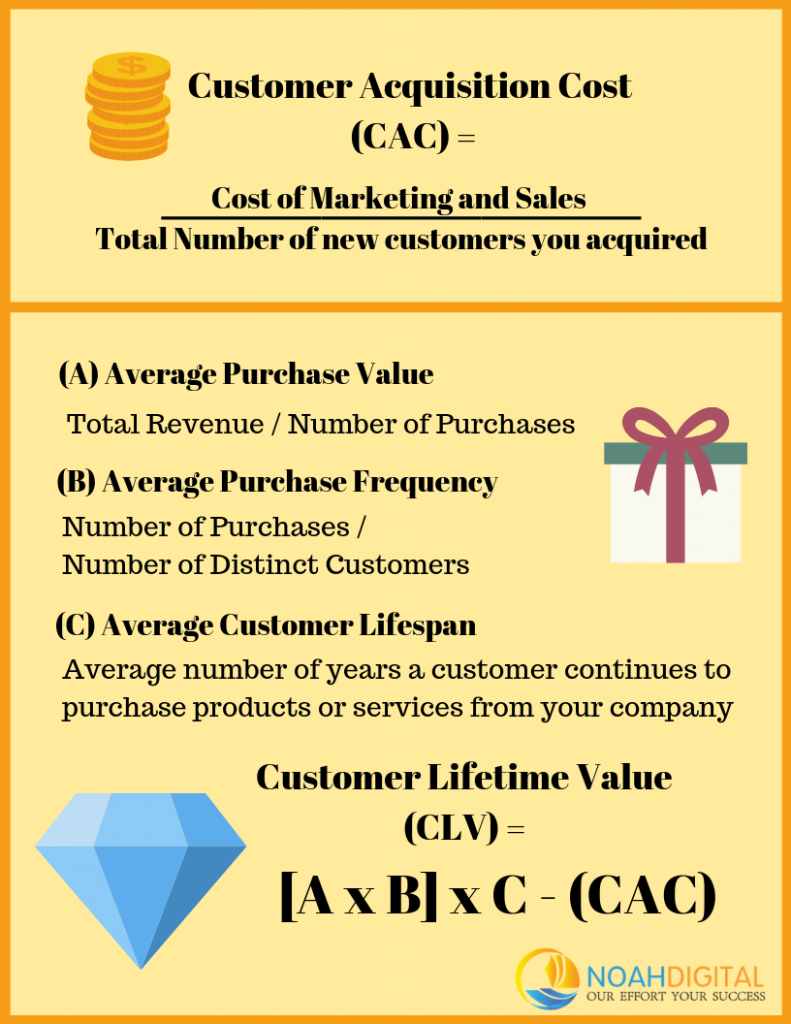

CAC = Cost of Marketing and Sales / Total Number of new customers you acquired

In a total expense segment, you should consider all the marketing elements and resources such as salary, paid marketing, overheads, and the tools that you use.

Different marketing channels bring you different results. So, it is not a good idea to bundle all of them together into one CAC expense. Instead, you should plan on calculating CAC expense for each marketing channel separately to understand which channel is the most effective or to see which one is bringing better results. If you run a paid search campaign, you need to know the CAC for your paid search channel.

For example:

PPC campaigns cost per lead: $60

Number of leads to acquiring a new customer: 10

Lead to new customer conversion rate: 10%

Total CAC: $600 plus other non-PPC costs to acquire this new customer

Vice versa, if you know your CAC, you can easily calculate how much you are willing to pay for a lead from your paid search channel and your ad budget.

For example:

CAC after deducting other non-PPC costs to acquire a new customer: $600

Conversion rate: 10%

Number of leads to acquiring a new customer: 10

Expected cost per lead: up to $60

If you want to have 100 leads per month, your ad budget should be $6000.

What Exactly Is Customer Lifetime Value or CLV?

Customer lifetime value measures the total profit derived from a customer during the time that they are a customer of the company.

CAC is one metric that is quite tricky as you should take into account all the marketing expenses into consideration since the profits you get from each customer varies. The gain might be more when it is not just a one-off sale. No doubt that CAC is crucial as it helps you understand one aspect of the business. But, it fails to capture and give you the full picture. That’s the key reason why you should also consider CLV (customer lifetime value).

The three crucial factors that affect your CLV are cross-selling, retention, and upselling. Focussing on improving these three factors will help you improve the customer lifetime value.

Here’s How You Calculate the CLV:

CLV = (Average Purchase Value X Average Purchase Frequency) X Average Customer Lifespan – Customer Acquisition Cost(CAC)

Average Purchase Value: You can find this information by dividing the total revenue of the company in a specific period (typically one year) by the total number of purchases during that period.

Average Purchase Frequency: You need to divide the total number of purchases in a specified time with the total number of distinct customers that have made the purchases.

Average Customer Lifespan: Found by averaging the number of years a customer does business with your company and continues purchasing your products/services.

The formula ((Average Purchase Value X Average Purchase Frequency) X Average Customer Lifespan) provides you with an estimate of revenue that you can possibly generate through a customer during the time they stay active with your firm.

Lastly, you need to subtract the initial cost to acquire the customers (CAC) to track the profit you make and not just the revenue.

For example: If you have 1 customer that purchases your product every month for $10. This makes 12 purchases over the course of a year, making you $120 every year from these customers. Typically, a customer will continue to make this purchase for 2 years.

Your average purchase value will be $10 ($120 / 12 purchases).

Your average purchase frequency will be 12 (12 purchases / 1 distinct customers).

Your average customer lifespan will be 2 (The customer typically makes this purchase for 2 years).

Your customer acquisition cost (CAC) is $100.

Therefore, your customer lifetime value will be $140 (CLV = [$10 x 12] x 2 – $100).

Relationship Between CLV and CAC

It is natural for you to expect your CAC to be less and the CLV to be high. If you are spending less money to acquire a customer and the overall value of your customer is high, you will make a profit. On the other hand, your business will incur losses if your CAC is high and your CLV is low.

As per Klipfolio, if you want to understand the estimated customers value, and how much money you should spend to earn them, you need to understand the CLV to CAC ratio. Typically, the CLV:CAC ratio should be 3:1. This means the total value of the customer needs to be 3 times more than the cost to acquire them.

If it is 1:1 or something similar, it essentially shows that you are just breaking even. If the ratio is higher than 3:1, like 5:1, it could be an indication that you are not spending enough on sales and marketing to acquire new customers.

This ratio will help you understand if your paid search campaign is profitable or if you need to optimize your campaigns to increase conversion rate. Of course, conversion rate optimization is an on-going process. You should continuously optimize and test your PPC campaigns and website/landing page for better results. Your sales team also need to be able to effectively close a deal if you use PPC campaigns to generate leads.

What Can You Take From This?

By calculating CAC and CLV, you will soon know if you are getting a good ROI on the money you are spending on PPC advertising. You will see the value online advertising brings to your business. Doing this will also help you better evaluate how your business is performing, and if you should adjust your marketing strategy based on the data collected.